There are commercial services that let you log trades, but they can be expensive and not always available for every trading platform.

This is a list of Excel templates and spreadsheets that are good as a trading log for crypto trading. Often you can adopt templates from stock trading, if you trade on technical analysis, or from forex, if you scalp.

In this video – ‘How I Use My Excel Spreadsheet Trading Journal’ I briefly talk about the different options available when it comes to choosing what to actually create your trading journal in – mainly Microsoft Excel or Evernote. I then move on to what information you should record in your journal spreadsheet.

The trading journal templates are ordered by complexity, from the simplest template to the more complex.

- The simplest trading log spreadsheets include market, direction, entry price, exit price, amount.

- The more complex trading log templates have additional fields for notes on the pattern or setup you traded on, and space for notes about your market predictions.

This is a list of Excel templates and spreadsheets that are good as a trading log for crypto trading. Often you can adopt templates from stock trading, if you trade on technical analysis, or from forex, if you scalp. The trading journal templates are ordered by complexity, from the simplest template to the more complex. Hi Guys, I am new to this forum but thought I would post a template of my trading journal I have just made because after searching the net I couldn’t find one that exactly fitted my needs so I made this one. It may still need some ironing out and any feedback is appreciated. I hope some others find this useful. Cheers Trade Journal.zip (127 KB).

The more information you log (within reason) the more accountable you can hold yourself.

Basic: Crypto Trading Log Spreadsheet

This is your super simple trading journal spreadsheet. It only has the fields that are absolutely necessary, but at least it doesn’t take forever to log your trades.

There is no built in analysis, you will have to process the spreadsheet yourself.

Trading log fields:

- Opened (date)

- Closed (date)

- Market

- Setup (…on which you traded)

- Direction

- Entry (price)

- Target (price)

- Exit (price)

- Size

- PnL

- Funding (cost)

- Fee (cost)

- Notes

Get this spreadsheet: Open the Google Sheet - Click 'File' > 'Make a Copy'

Intermediate: EarnForex Excel Trade Journal

The Google spreadsheet version modified for crypto is linked below.

The original EarnForex Excel Log (v3.0 from 2020)

The EarnForex Excel template in its original form already includes all the things you will need in crypto. The modifications of its 2020 version are minimal - change the forex markets to crypto markets and you’re good.

The template comes with an analysis sheet. Source

Original trading log fields included:

- Open Date

- Strategy (such as “double bottom”)

- FX No (number of the market from the sheet that lists your markets)

- Currency Pair

- Direction (long / short or put / call)

- Entry Price

- Initial Stop

- Initial Target

- IRR

- Position Size

- Exit Price

- Close Date

- Profit/Loss

- Swap (your costs of margin funding)

- Commission (trading fee charged by the exchange)

- Length (scalp, swing)

- Open Comment (your reasoning for entering)

- Close Comment (your reason for exiting, whether it was scaled in or at once, or stopped out)

- End Balance

EarnForex Excel Log Adopted for crypto

The link below is a (work in progress) - the EarnForex’s Forex trading log transformed into Google Spreadsheet and modified for crypto markets.

With this version of the trading journal, 10 different crypto markets are set up for you. You can overwrite them into any other pairs, depending on which markets you trade. But remember to also modify the column with Google Finance integration that gets you the conversion rate into USD.

Thanks to this data, your PnL is calculated in the base currency and in current USD rate for that base currency.

To learn from jour trading journal, rate of return will probably tell you more about your trades. This trading log calculates both your expected rate of return (from your target price) and the realised rate of return for each trade.

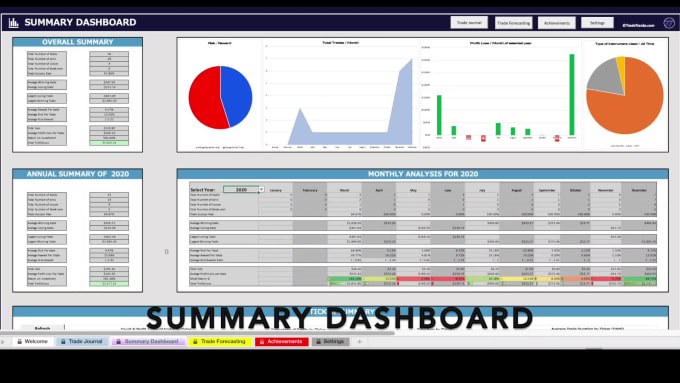

Trading Journal Spreadsheet Download

The Analytics tab breaks down your trades by several metrics:

- Total USD Profit or loss based on traded pair

- Total USD Profit or loss based on technical analysis, pattern or setup

- Total USD Profit or loss based on direction of your position

Other than that the fields are more or less the same as in the forex log above.

Get this spreadsheet: Open the Google Sheet - Click 'File' > 'Make a Copy'

2021 UPDATE: Read my guide to the Best Trading Journals tips on how to successfully maintain your journal.

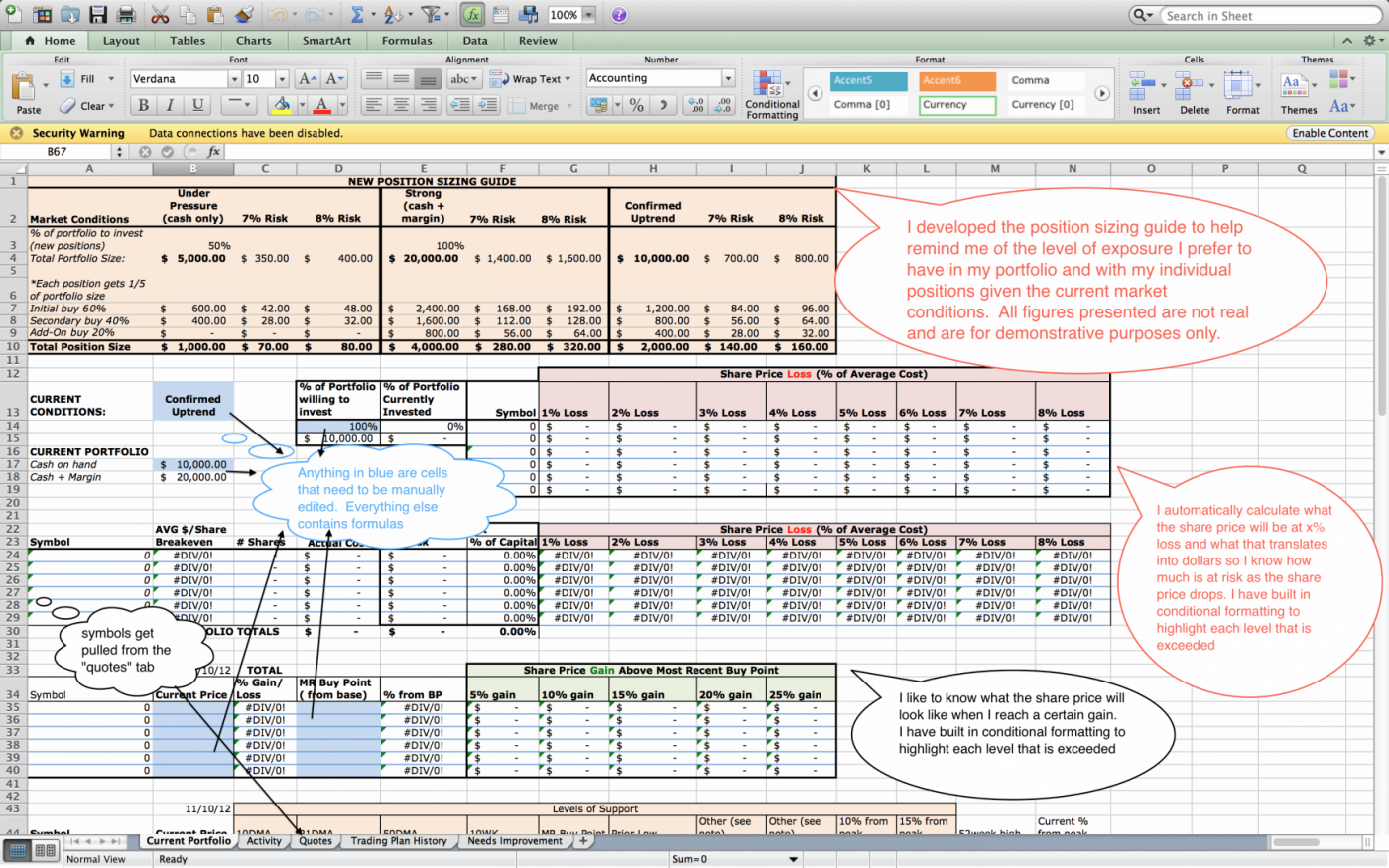

Trading journal spreadsheet download

I've had quite a few requests for a copy of the spreadsheet I use for my trading journal. I uploaded it to the server so feel free to download a copy if you're interested. It's not the most elegant spreadsheet but it does what I need.

Here's some details about the columns included:

- Expectancy: An average of column K (R Multiple). This formula must be modified each day to include the latest rows.

- Total P&L: Sum of column J (P&L)

- Trade #: Just used for some calculations later...

- L/S: Long or short

- QTY: Number of shares

- Bought: Purchase price

- Sold: Selling price

- Initial risk: Dollars at risk based on the initial stop

- Comm: Commission for both sides of the trade. I have it set to calculate based on the number of shares entered in column E.

- P&L: The actual P&L, including commission

- R Multiple: P&L divided by the initial risk

- % Wins: This is calculated by dividing column R (sum W/L) by column A (trade #)

- Comments: I use this to list errors made on the trade or anything else worth noting.

- $ at Work: This gives me an idea of how much money was in the position. It's simply QTY (column E) divided by Bought (purchase price). Note that this is not accurate for shorts but it's close enough for government work. :-)

- % P&L: The percentage return for the trade. P&L divided by $ at Work. Again, not exact for shorts.

- Initial % risk: Just tells me how far my stop was from my entry in percentage terms.

- W/L: Tells whether the trade was a winner (1) or a loser (0). This is used by the next column, Sum W/L.

- Sum W/L: A running total of the W/L column. This is used in the % Wins column.

Have ideas for how I can improve the spreadsheet? Email me!

Trading Journal Spreadsheet Template

2021 UPDATE: Read my guide to the Best Trading Journals tips on how to successfully maintain your journal.

Read Next

Trading Journal Spreadsheet Xls

About the Author

Blain Reinkensmeyer As Head of Research, Blain Reinkensmeyer has 18 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, Blain has been quoted in The New York Times, Forbes, and the Chicago Tribune, among others.